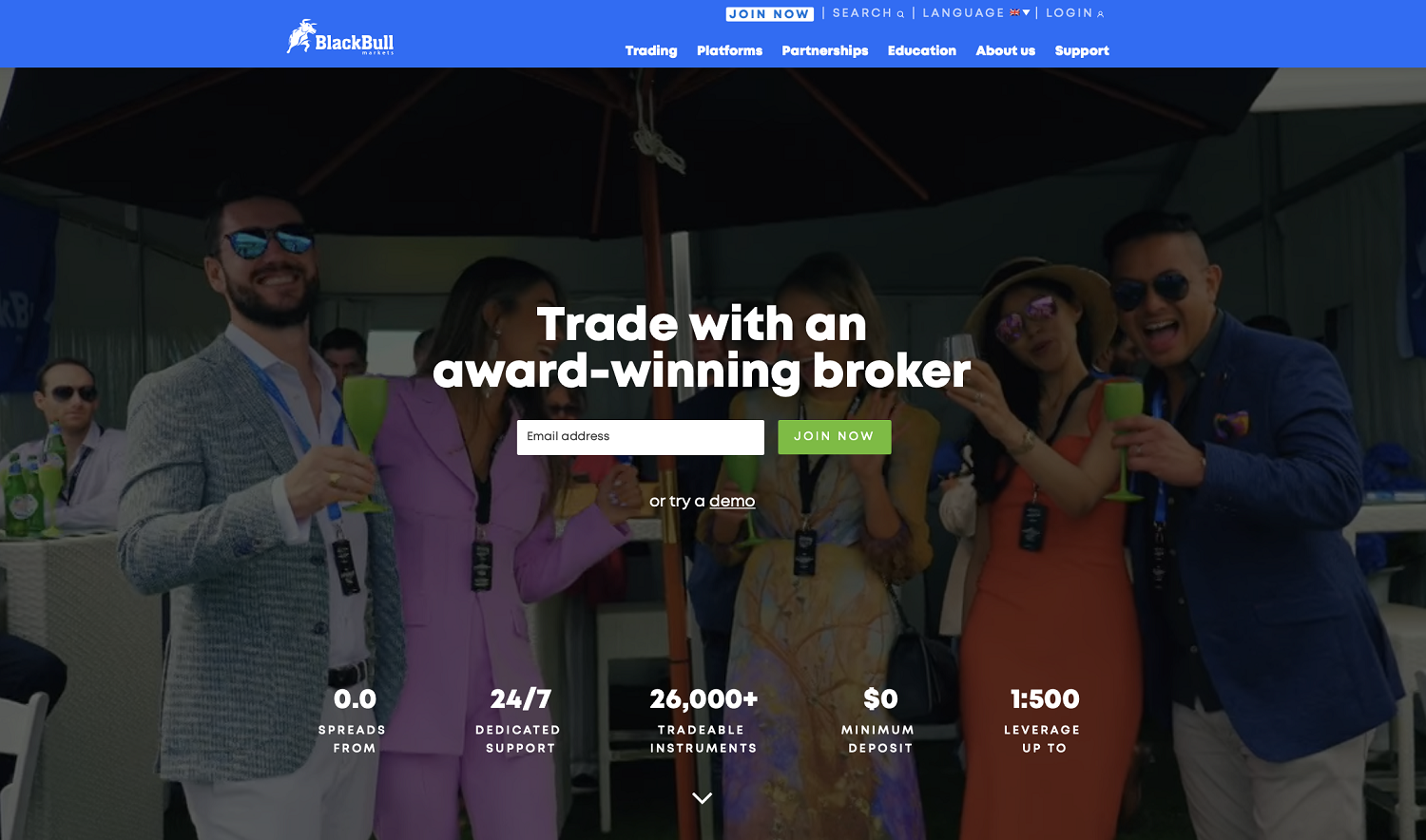

BlackBull Markets Review: A Reliable Brokerage for Australian Traders Review

BlackBull Markets is a renowned brokerage firm that has been serving traders globally since its establishment. In this review, we will delve into the features, services, and overall trading experience offered by BlackBull Markets specifically for Australian traders. From trading platforms to account types, we’ll explore the key aspects to help you make an informed decision about choosing this broker.

Trading Platforms

BlackBull Markets provides Australian traders with a range of trading platforms to suit their preferences. The most popular option is MetaTrader 4 (MT4), a widely recognized platform known for its stability, user-friendly interface, and advanced charting capabilities. Additionally, BlackBull Markets also offers the MetaTrader 5 (MT5) platform, which includes more advanced features such as hedging options and a broader range of asset classes.

Account Types

BlackBull offers different account types to cater to the varying needs of traders. Australian clients can choose between three main account types: Standard, Prime, and Institutional. The Standard account requires a minimum deposit of AUD 200 and is suitable for beginner and intermediate traders. The Prime account, with a minimum deposit of AUD 2,000, provides enhanced trading conditions and lower spreads. The Institutional account is designed for professional traders with specific requirements.

Black bull markets trading on iPhone

BlackBull offers a user-friendly and feature-rich mobile trading experience for iPhone users through its mobile trading applications. With the BlackBull app, you can access your trading account, monitor the markets, execute trades, and manage your positions directly from your iPhone. Here are some key features and benefits of trading with BlackBull Markets on your iPhone:

- Mobile Trading Platform: The BlackBull app for iPhone provides a powerful and intuitive trading platform that is optimized for mobile devices. It allows you to trade on the go, giving you the flexibility and convenience to monitor the markets and execute trades anytime and anywhere.

- Easy-to-Use Interface: The mobile app is designed with a user-friendly interface, making it easy for both novice and experienced traders to navigate and utilize its features. You can access real-time price quotes, charts, technical indicators, and account information with just a few taps on your iPhone screen.

- Trade Execution: With the BlackBull app, you can execute trades directly from your iPhone. You can place market orders, limit orders, stop-loss orders, and take-profit orders with ease. The app ensures fast and reliable trade execution, allowing you to take advantage of trading opportunities as they arise.

- Charting and Analysis: The mobile trading app provides advanced charting capabilities, allowing you to perform technical analysis and make informed trading decisions. You can customize chart timeframes, apply various technical indicators, and draw trendlines or other graphical tools on the charts. This enables you to analyze price patterns and trends on the go.

- Account Management: The app allows you to manage your trading account efficiently. You can monitor your open positions, view your account balance and equity, check transaction history, and access detailed reports and statements. The account management features provide you with a comprehensive overview of your trading activity and performance.

- Notifications and Alerts: The BlackBull app for iPhone offers customizable push notifications and alerts. You can set up price alerts, news alerts, and other notifications to stay informed about market developments and track specific trading instruments. This feature helps you stay updated even when you’re not actively monitoring the markets.

- Secure and Reliable: BlackBull Markets prioritizes the security and reliability of its mobile trading app. The app utilizes advanced encryption protocols and security measures to ensure the safety of your personal and financial information. Additionally, the app’s stability and fast execution speed contribute to a seamless trading experience on your iPhone.

To start trading with BlackBull Markets on your iPhone, you can download the app from the Apple App Store. Once installed, log in using your BlackBull Markets account credentials, and you’ll be ready to access the markets and trade from your iPhone’s screen.

BlackBull Markets markets trading on android

BlackBull Markets offers a comprehensive and convenient trading experience for Android users through its mobile trading application. The BlackBull Markets app for Android allows you to access your trading account, monitor the markets, execute trades, and manage your positions directly from your Android device. Here are some key features and benefits of trading with BlackBull Markets on your Android:

- Mobile Trading Platform: The BlackBull Markets app provides a powerful and user-friendly trading platform that is specifically designed for Android devices. With this app, you can trade on the go, giving you the flexibility and convenience to monitor the markets and execute trades anytime and anywhere.

- Intuitive Interface: The mobile app features an intuitive interface that is easy to navigate, making it suitable for traders of all experience levels. You can access real-time price quotes, interactive charts, technical indicators, and account information with just a few taps on your Android device.

- Trade Execution: The app allows you to execute trades directly from your Android device. You can place various types of orders, including market orders, limit orders, stop-loss orders, and take-profit orders. The app ensures fast and reliable trade execution, allowing you to capitalize on trading opportunities in real time.

- Advanced Charting and Analysis: The mobile trading app offers advanced charting capabilities, enabling you to perform in-depth technical analysis. You can customize chart timeframes, apply a wide range of technical indicators, and draw trendlines or other graphical tools on the charts. This helps you analyze price patterns, identify trends, and make informed trading decisions.

- Account Management: The app provides efficient account management features. You can monitor your open positions, view your account balance and equity, check transaction history, and access detailed reports and statements. The app’s account management features offer a comprehensive overview of your trading activity and performance.

- Notifications and Alerts: The BlackBull Markets app for Android offers customizable push notifications and alerts. You can set up price alerts, news alerts, and other notifications to stay updated on market developments and track specific trading instruments. This feature allows you to stay informed even when you’re not actively monitoring the markets.

- Secure and Reliable: BlackBull Markets prioritizes the security and reliability of its mobile trading app. The app utilizes advanced encryption protocols and security measures to protect your personal and financial information. Furthermore, the app’s stability and fast execution speed contribute to a seamless trading experience on your Android device.

To start trading with BlackBull Markets on your Android device, you can download the app from the Google Play Store. Once installed, log in using your BlackBull Markets account credentials, and you’ll have access to the markets and trading functionality right from your Android device.

To register an account with BlackBull Markets, you can follow these general steps:

- Visit the BlackBull Markets website: Go to the official BlackBull Markets website using a web browser of your choice.

- Click on “Open Account” or “Register”: Look for a prominent button or link on the website that says “Open Account” or “Register.” Click on it to start the account registration process.

- Select the account type: Choose the account type that suits your trading needs. BlackBull Markets typically offers different account options such as Standard, Prime, and Institutional. Consider factors such as your trading experience, deposit amount, and desired trading conditions when selecting the account type.

- Fill in the registration form: Provide the required information in the registration form. This may include personal details such as your name, email address, phone number, country of residence, and preferred base currency. Make sure to provide accurate information.

- Agree to the terms and conditions: Read and agree to the terms and conditions set by BlackBull Markets. It’s essential to understand the obligations, rights, and responsibilities associated with opening an account with the brokerage.

- Submit the registration form: After filling in the necessary information and agreeing to the terms and conditions, submit the registration form.

- Account verification: BlackBull Markets may require you to verify your identity and address to comply with regulatory requirements. This typically involves providing identification documents such as a passport or driver’s license, as well as proof of address documents like utility bills or bank statements. Follow the instructions provided by BlackBull Markets to complete the verification process.

- Fund your account: Once your account is verified and approved, you can proceed to fund your trading account. BlackBull Markets usually offers various deposit methods, including bank transfers, credit/debit cards, and online payment systems. Choose the most convenient option for you and follow the instructions provided.

- Start trading: After funding your account, you can log in to the trading platform provided by BlackBull Markets using the credentials provided during the registration process. You can then start exploring the available trading instruments, placing trades, and managing your account.

To log in to your BlackBull Markets account, follow these steps:

- Visit the BlackBull Markets website: Open a web browser and go to the official BlackBull Markets website.

- Locate the “Client Login” or “Log In” section: Look for a prominent section on the website that allows you to log in to your account. This section is usually located in the top right corner of the webpage.

- Enter your login credentials: In the designated fields, enter your registered email address or username and your account password. Make sure to double-check the information for accuracy.

- Choose the trading platform: BlackBull Markets offers different trading platforms such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Select the trading platform you wish to use from the provided options.

- Click on the “Login” or “Sign In” button: After entering your login credentials and choosing the trading platform, click on the corresponding button to proceed.

- Access your trading account: If the provided login information is correct, you will be logged in to your BlackBull Markets trading account. You will gain access to the platform’s features, including trading instruments, charts, account information, and other relevant tools.

- Start trading or managing your account: Once logged in, you can start trading by analyzing the available instruments, placing trades, and managing your positions. You can also access account settings, funding options, and contact customer support if needed.

Trading Instruments

BlackBull Markets offers a wide range of tradable instruments, allowing Australian traders to diversify their portfolios. Clients can access various currency pairs, including majors, minors, and exotics, as well as metals like gold and silver. Additionally, the broker provides access to CFDs on indices, commodities, and cryptocurrencies, providing ample opportunities for traders with different preferences.

Regulation and Safety

Regulation is a crucial aspect when choosing a broker. BlackBull Markets holds the Financial Services Provider (FSP) license from the Financial Markets Authority (FMA) of New Zealand. Although it’s not an Australian regulatory body, the FMA is known for its stringent regulations and investor protection measures. BlackBull Markets follows strict compliance procedures to ensure client fund segregation and employs advanced security protocols to safeguard personal and financial information.

Customer Support

BlackBull Markets places great emphasis on customer support. Australian traders can expect prompt and knowledgeable assistance from the broker’s customer support team. The support desk operates 24/7 and is available through multiple channels, including live chat, email, and phone. The broker’s website also provides an extensive knowledge base and educational resources to help traders enhance their skills and understanding of the market.

BlackBull Markets Australia faqs

While BlackBull Markets is not directly regulated in Australia, it holds a Financial Services Provider (FSP) license from the Financial Markets Authority (FMA) of New Zealand. The FMA is known for its stringent regulations and investor protection measures, ensuring a certain level of security for Australian traders.

What trading platforms does BlackBull Markets offer to Australian clients?

BlackBull Markets provides Australian traders with access to the popular MetaTrader 4 (MT4) platform, known for its stability, user-friendly interface, and advanced charting capabilities. Additionally, the broker also offers the MetaTrader 5 (MT5) platform, which includes more advanced features and broader asset class options.

What account types are available for Australian traders?

BlackBull Markets offers three main account types to Australian traders: Standard, Prime, and Institutional. The Standard account is suitable for beginners and intermediate traders, with a minimum deposit requirement of AUD 200. The Prime account, requiring a minimum deposit of AUD 2,000, provides enhanced trading conditions and lower spreads. The Institutional account is designed for professional traders with specific requirements.

What trading instruments can I access with BlackBull Markets?

BlackBull Markets offers a wide range of trading instruments for Australian clients. You can access various currency pairs, including majors, minors, and exotics. In addition, the broker provides access to metals such as gold and silver, as well as CFDs on indices, commodities, and cryptocurrencies, offering diverse trading opportunities.

How can I contact customer support at BlackBull Markets?

BlackBull Markets offers a dedicated customer support team that operates 24/7 to assist Australian traders. You can reach them through various channels, including live chat, email, and phone. The broker’s website also provides an extensive knowledge base and educational resources to help traders enhance their skills and understanding of the market.

What security measures does BlackBull Markets have in place?

BlackBull Markets prioritizes the security of its clients’ personal and financial information. The broker follows strict compliance procedures, including the segregation of client funds, to ensure their safety. Additionally, BlackBull Markets employs advanced security protocols and encryption technologies to protect sensitive data from unauthorized access.

Contact

JUC Building, Office F7B, Providence Zone 18, Mahe, Seychelles